Medicare tax calculation 2023

How to read the EITC tables. Automatic calculation of taxable social security benefits.

Medicare And Taxes How Your 2023 Medicare Premiums Are Affected By Your 2021 Tax Filing Gobankingrates

To start claiming this credit you must have at least 1 of earned income with line 2 showing the minimum amount of earned income required to get the maximum earned.

. Government Publishing Office Page 134 STAT. Every month you delay benefits increases your checks slightly until you reach. The low income earner exemption thresholds were also raised.

When you file your 2022 federal income tax return in 2023 attach Schedule H Form 1040 to your Form 1040 1040-SR 1040-NR 1040-SS or 1041. You can quickly estimate your Ohio State Tax and Federal Tax by selecting the tax year your filing status Gross Income and Gross Expenses this is a great way to compare salaries. CMS proposes several payment policy changes including rebasing and revising the Medicare.

Part B Monthly Premium 95000 or less. Comments are due on Sept. Above 95000 119000.

Before sharing sensitive information make sure youre on a federal government site. Tax on this income. A self-employment tax feature.

The amount the IRS allows as a set deduction based on the number of people in your. 281 Public Law 116-136 116th Congress An Act To amend the Internal Revenue Code of 1986 to repeal the excise tax on high cost employer-sponsored health coverage. Therefore the payer of your periodic pension or annuity payments or nonperiodic payments and.

The calculation doesnt just use the latest month over the same month a year ago. Tax Rates 2022-2023. Above 190000 238000.

2022 2023 2024 Medicare Part B IRMAA Premium MAGI Brackets. Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023. CMS officials say that reflecting the savings in what Medicare will likely have to spend on those beneficiaries who will be eligible for Aduhelm in the calculation of the 2023 Medicare Part B premium is the most effective way to deliver these savings back to people with Medicare Part B CMS is expected to announce the 2023 Part B premium in the fall.

As we stated in the CY 2023 PFS proposed rule a draft of the updated Medicare Ground Ambulance Data Collection Instrument PDF that includes all of the CY 2023 proposed changes to review and provide comments on is posted here. It primarily provides health insurance for Americans aged 65 and older but also for some younger people with disability status as determined by. If you begin claiming at 62 youll get only 70 of your standard benefit if your FRA is 67 or 75 if your FRA is 66.

Prior to the switch in coverage we will be receiving the subsidy by way of a reduction in our monthly premium payment. If your filing status and MAGI in the tax year 2021 was. Get the latest money tax and stimulus news directly in your inbox.

2022 personal income tax rates and thresholds as published by the ATO. Marketplace Stakeholder Technical Assistance Tip Sheet on the Monthly Special Enrollment Period for Advance Payments of the Premium Tax Credit Eligible Consumers with Household Income at or below 150 of the Federal Poverty Level PDF April 28 2022 Final 2023 Letter to Issuers in the Federally-facilitated Exchanges PDF July 18 2022. The full 15 is only applied to singles who earn more than 140k a year or couples.

Begin using the forms until January 1 2023. The gov means its official. This simplified calculation of capital gains and losses.

The 78k salary example is great for employees who have standard payroll deductions and for a quick snapshot of the take home amount when browsing new job opportunities in Australia for those who want to compare salaries have non-standard payroll deductions of simply wish to produce a bespoke. Click Calculate to see your tax medicare and take home breakdown - Federal Tax made Simple. Business Tax Deduction.

The American Rescue Plan Act stipulates that the nonrefundable pieces of the employee retention tax credit will be claimed against Medicare taxes instead of against Social Security taxes as they were in 2020. Federal government websites often end in gov or mil. Also calculates your low income tax offset HELP SAPTO and medicare levy.

116th Congress Public Law 136 From the US. Additional Medicare Tax applies to Medicare wages Railroad Retirement Tax Act compen-sation and self-employment income over 200000 if you are filing as single head of. Low income tax offset from 2022 to 2023 18200 37000 700.

When she switches to Medicare we will terminate her Exchange coverage effective July 31 2023 and her Medicare coverage will start on August 1 2023. But are projected to become larger after 2023 due to higher projected provider payment updates. Calculate your total tax due using the MN tax calculator update to include the 202223 tax brackets.

19c for each 1 over 18200. Business owners must include their business earnings when they file their tax returns. Tax Return Access.

The Medicare levy was raised again by the Keating Labor Government in July 1993 up to 14 of income again to fund additional healthcare spending outlays. For the 75-year projection period the HI actuarial deficit has decreased to 070 percent of payroll from 077 percent in last years report and is equivalent to 03 percent of GDP through 2096. The calculation of net profit versus net loss for business owners.

Deduct the amount of tax paid from the tax calculation to provide an example of your 202223 tax refund. Terms and conditions may vary and are subject to change without notice. In August of 2023 my wife will turn 65 and be eligible for Medicare.

For the purposes of this calculation this site assumes you are Single and your Rebate Income equals your Taxable Income. The Ohio State Tax Calculator OHS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223To estimate your tax return for 202223 please select the 2022 tax year. 202223 Minnesota State Tax Refund Calculator.

In the Department of Health and Human Services HHS Notice of Benefit and Payment Parameters for 2023 Final Rule released today the Centers for Medicare Medicaid Services CMS is finalizing standards for issuers and Marketplaces as well as requirements for agents brokers web-brokers and issuers assisting consumers with enrollment through. The Medicare levy surcharge is an additional tax of between 1 and 15 depending on how much you earn. PROJECTED 2023 IRMAA BRACKETS FOR MEDICARE PART B.

The Centers for Medicare Medicaid Services CMS released the Calendar Year CY 2023 Medicare Physician Fee Schedule PFS Proposed Rule on July 7 2022 which impacts Medicare Part B payments starting Jan. It also includes. August 20 2022 by Harry Sit in Healthcare.

Social security and Medicare tax for 2022. Medicare is a government national health insurance program in the United States begun in 1965 under the Social Security Administration SSA and now administered by the Centers for Medicare and Medicaid Services CMS. The maximum earned income credit allowedpayable for the given tax year is shown in line 1.

These changes if finalized would be effective on or after January 1 2023. Social Security and Medicare Boards of Trustees. The cap on wages for the Medicare tax was removed by The Omnibus Budget Reconciliation Act of 1993 or OBRA-93.

The employee calculation of full-time equivalent FTE used for the PPP forgiveness report is not calculated the same way as a full. File Individual Tax Return. File Joint Tax Return.

Coding For Pediatrics 2023 A Manual For Pediatric Documentation And Payment 9781610026406 Medicine Health Science Books Amazon Com

Medicare Part B Premiums For 2022 Jump By 14 5 From This Year Far Above The Estimated Rise In Cost Medicare Tax Brackets Required Minimum Distribution

4 Social Security Changes To Expect In 2023 The Motley Fool

My First Million By 16th October 2023 How To Get Money Credit Card App Business Travel Outfits

Cola 2023 Projection Of The Increase In The Social Security Check For 2023 Marca

Could 2023 Social Security Cola Hit 9 Benefitspro

2022 Wage Cap Jumps To 147 000 For Social Security Payroll Taxes

Proposed Law Impact On Social Security Taxable Wage Base Isdaner Company

Why A Record Cola Increase In 2023 Could Backfire On Seniors

Yes Social Security S Cost Of Living Adjustment For 2023 Is Expected To Be Higher Than Average Youtube

Social Security What Is The Wage Base For 2023 Gobankingrates

Biden S 5 79 Trillion 2023 Budget Proposal Would Also Expand Regulation

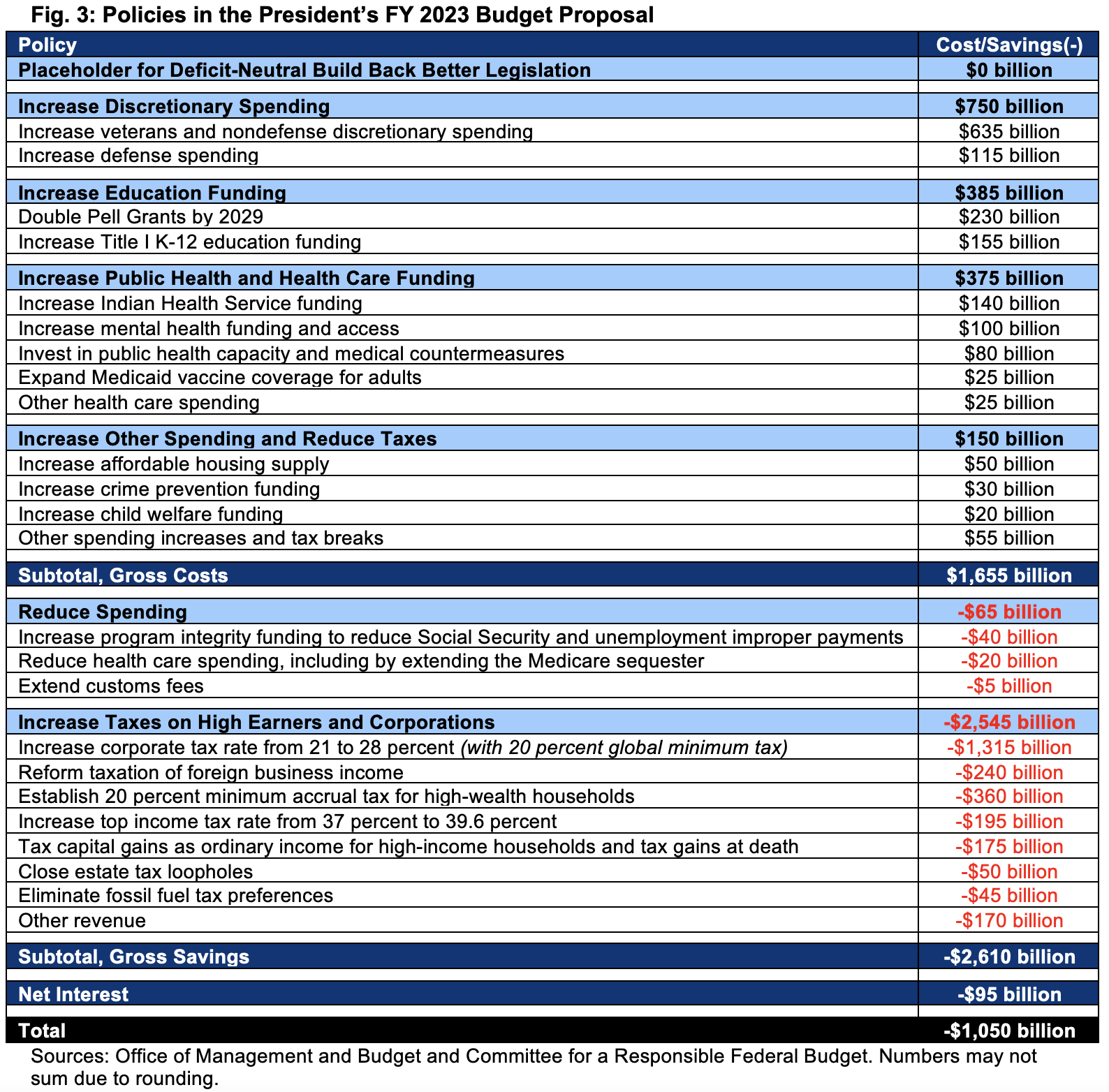

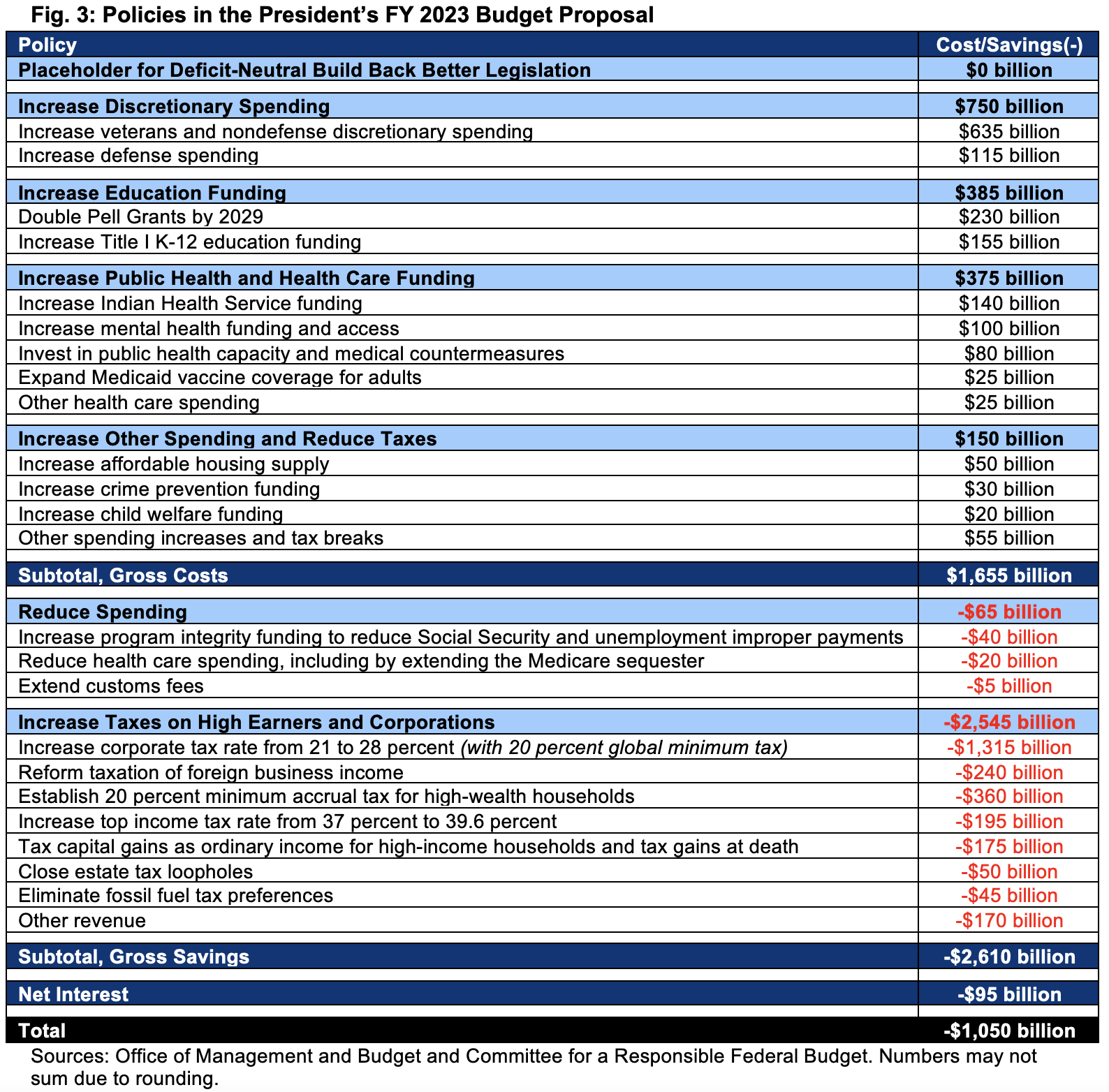

Analysis Of The President S Fy 2023 Budget Committee For A Responsible Federal Budget

Who S Ready For 6 Big Changes To Social Security In 2023 The Motley Fool

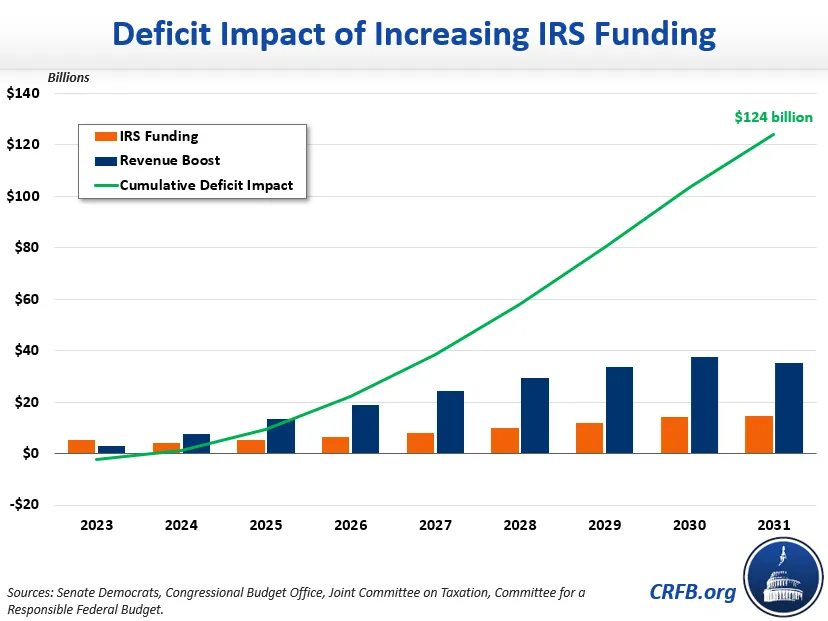

The Inflation Reduction Act Would Reduce The Tax Gap Committee For A Responsible Federal Budget

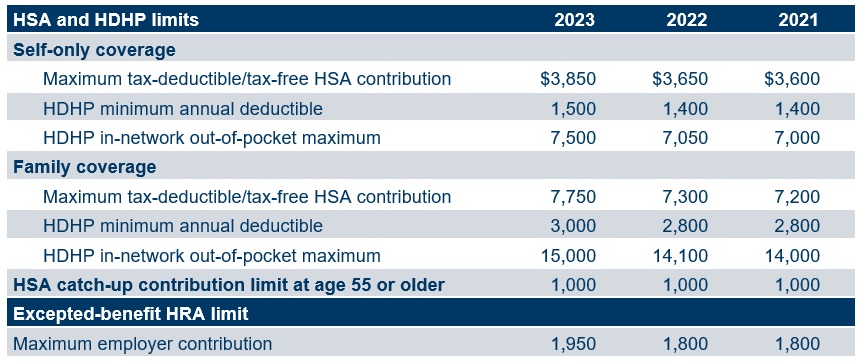

2023 Hsa Hdhp And Excepted Benefit Hra Figures Set Mercer

Social Security Benefits 2023 When Will The Cola Increase Be Decided Marca